Insights

Centrally Cleared Repo Market Brief

Through innovative and flexible cash investment and financing solutions, we provide both our custody and third-party clients access to the Fixed Income Clearing Corporation (FICC) sponsored repo platform.

Given the interconnectivity between repo markets, monetary policy and macroeconomic trends, we want to help you stay up to date on what’s happening in the market with a specific focus on the rapidly growing sponsored segment. With views on recent market trends and what to expect in the future, our quarterly briefs give you the insight you need to unlock the benefits of centrally cleared repo.

April 2023

Highlights from this quarter

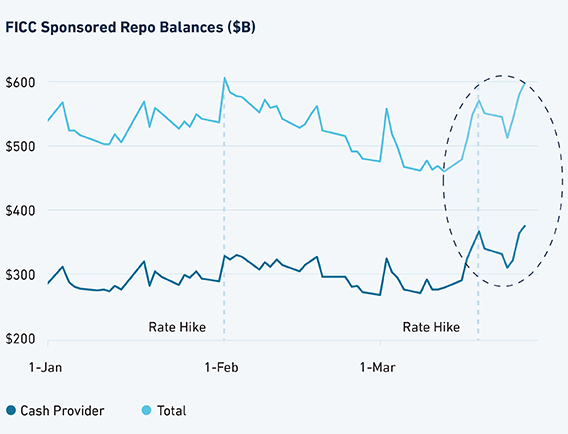

- As 50bps of rate hikes and quantitative tightening continued this quarter, overnight repo demand increased and SOFR consistently printed above RRP. The failures of Silicon Valley Bank and Signature Bank put pressure on markets and further exacerbated the move towards repo as investors sought out secure, short-term outlets.

- The Fed RRP facility continues to be impacted by money market inflows (12% increase over the quarter) however overnight repo rates that generally cleared RRP and heightened cash flows due to market stress from the aforementioned bank failures drove volatility in RRP prints.

- Market perception of future Fed activity remains highly tied to economic data, although tremors from the bank failures in March rapidly shifted expectations.