Insights

February 2022

Preparing for the Wave of Climate Litigation

Litigation is increasingly being used strategically, around the world, as a means of forcing governments, investors, and companies to take actions or make decisions that will enable net zero goals to be met. What are the implications for companies, investors, and governments?

Ritu Shirgaokar

Head of legal, international and regulatory at State Street

Anna Bernasek

Head of thought leadership

Simon Orton

Partner, co-head of the FIG sector and a member of the Sustainability Leadership Group at Freshfields Bruckhaus Deringer LLP.

Last year in October, timed with the United Nation’s COP26 climate summit in Glasgow, the UK government unveiled its long awaited net zero emissions plan. By January two environmental groups started separate court proceedings against the UK government, arguing that plan failed to explain how emission cuts would be achieved.

These legal proceedings are the latest example of how litigation is increasingly being used strategically, around the world, as a means of forcing governments, investors, and companies to take actions or make decisions that will enable net zero goals to be met.

So what are the implications for companies, investors, and governments?

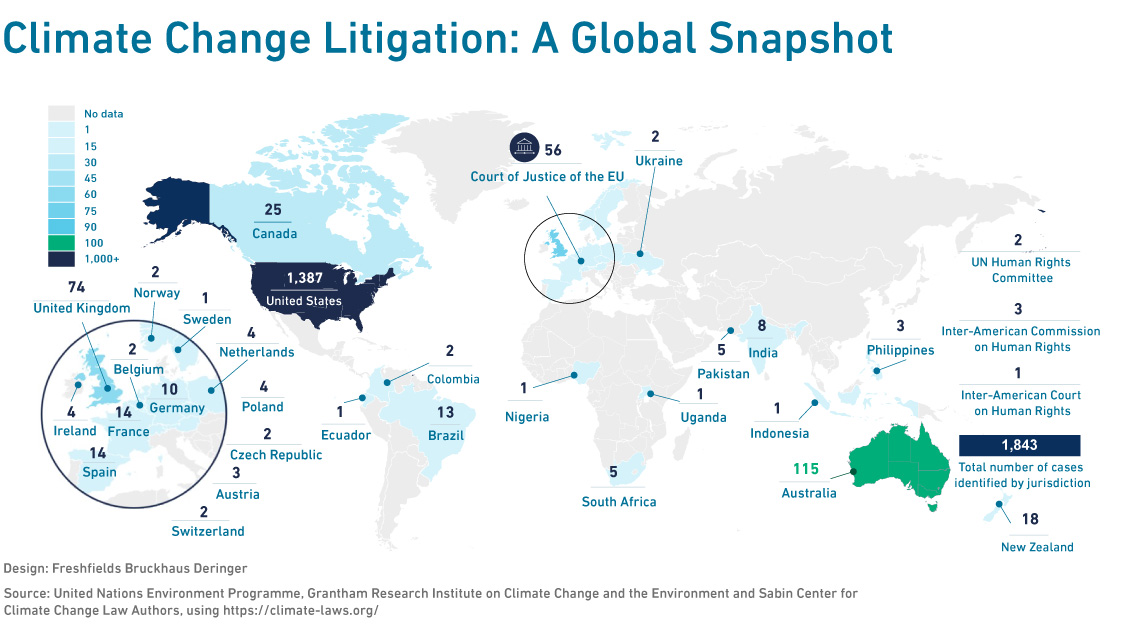

First, it’s important to understand the current climate litigation landscape. Between 2017 and 2020, the number of climate related court cases filed globally almost doubled and today there are over 1,800 live cases worldwide (Exhibit 1).[1] Three quarters of these cases are currently filed in the United States but that is likely to change as cases increasingly are being brought in the UK and other parts of the world.

It’s reasonable to expect climate litigation to grow in volume as awareness around climate change impact and risks increases and while responses from governments and regulators are uneven and often lagging. NGOs in particular could become the leaders in litigating for change.

Claims have been filed against a wide range of parties including corporations, financial institutions, asset managers and other asset owners including pension funds, governments and even central banks.

And there’s a diverse mix of claimants, often not motivated by financial gain but by a desire to press for change, generate publicity, and raise awareness.

In a case that became known as the “trial of the century,” four NGOs sought compensation from the French government in 2018 for ecological and non-material harm resulting from the government’s climate inaction.

The French government initially rejected the claim and the NGOs then filed a complaint in the Paris Administrative Court.

On February 3, 2021 the Paris Administrative Court found that there was ecological damage in France due to climate change and that the French government was partly responsible for the ecological damage. The Court ordered the French government pay one symbolic euro to the four NGOs in compensation for the moral prejudice resulting from the lack of climate public policy. On 14 October, 2021, the Paris Administrative Court ordered the French State to take all necessary remedial measures to comply with its commitments and to repair the damage caused by its failure to combat climate change, with a deadline of 31 December, 2022.

Cases against financial firms have included litigation or complaints under the OECD Guidelines aimed at forcing changes to policies or questioning how decisions were made. For example, an Australian superannuation fund agreed to change its approach to measuring and managing climate change-related (and other ESG-related) financial risks in settlement of litigation; an Australian bank agreed to disclose documents relating to its decisions to enter into particular transactions, again in response to a claim; a Dutch bank is the subject of an OECD complaint for financing the palm oil industry; and the Belgian National Bank is defending claims relating to the operation of the asset purchase scheme.

The spectrum of claims that are now being brought ranges from failure to assess and disclose climate risks, to failure to adopt carbon transition plans or investment policies that mitigate climate risk, to claims arising from action taken by organizations that is inconsistent with their public commitments, to claims for financial losses arising from climate change-related damage.

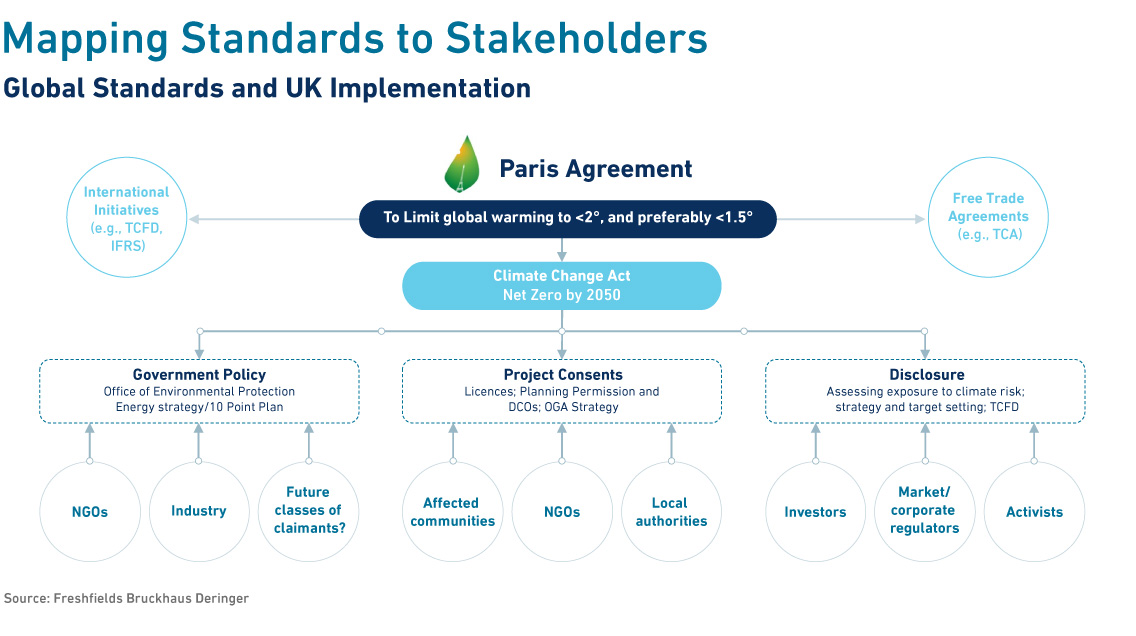

Looking ahead, litigation could increasingly be used by stakeholders to hold governments, investors, and companies accountable not only for implementing transition plans, but also for ongoing reporting and disclosure related to climate risk and progress toward public commitments (Exhibit 2).

Organizations should take note. Management of the climate transition involves many moving parts at every level. The rules are shifting, as are standards and expectations, while internal and external interests need to be balanced. Leaders will be called on to respond effectively. And it’s not just about ultimate goals. The plan and path for getting there is critical.

There are practical steps to consider that can help to mitigate climate litigation risk. For example:

- While every organization is different, it is increasingly important for each organization to set its own agenda rather than waiting for external pressure.

- Review climate-related commitments to ensure they are achievable and aligned with net zero goals.

- Ensure climate-related commitments and their implications are properly understood across the organization so that they can be delivered upon.

- Dedicate adequate resources and develop measures for keeping track of progress.

- Weigh public commitments carefully and strike a balance between meeting pressures to be ambitious whilst not over- promising.

- Stay current with new rules, recommendations and guidelines, taking account of both mandatory and voluntary disclosure guidance.

- Communicate climate related progress and disclosure to stakeholders.

- Keep track of decisions related to climate risk to demonstrate thoughtful, rigorous, consistent decision-making and proper record keeping.

Practical steps like these can go a long way to reduce reputational as well as legal and financial risks. Organizations that don’t effectively prepare risk exposing their commitments and actions to scrutiny in climate related litigation.